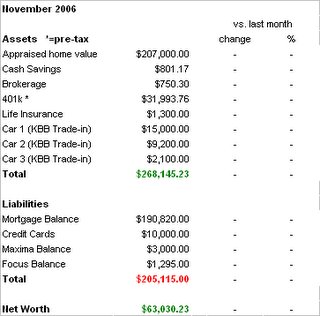

November Net Worth Update

November was a pretty good month overall, mainly due to the market being up. My 401k is at a 10.0% year-to-date return and I'll be extremely happy if I can hold onto that through December. There are no inputs for change vs. last month because I started with an estimate in certain categories (life insurance, credit card balance and car balances) so the change wouldn't be completely accurate. My life insurance is probably a little higher than what I have recorded, and the balance on the two cars is now within $10 (give or take) of what the actual payoff is. Things have been crazy this month with the acquisition of our new house and getting it ready to move into, and my wife handles the car payments, so I tried to get those numbers as close as possible. The credit card balance probably went up a tad, but $10,000 was only an estimate to begin with. Once we're moved (this weekend), things will be a little more in order.

Another thing that some people do when calculating their net worth is to add in the value of their personal "stuff," like electronics, furniture, collectibles, etc. Although technically this would contribute to one's net worth, I do not feel like it should be included. However, just for fun, here are some estimates on my (our) personal assets that are not included in my net worth:

TV: $2,500 (Brand new)

Furniture: $750 (Some if it is pretty old. This is a low estimate and includes living, dining and bedroom furniture.)

Kitchen appliances: $1500 (New refrigerator and stove)

Computer, DVD's: $500

Golf Clubs: $500

As you can see, I could skew my assets to include an additional $5,750. I think that's pretty significant, but, in my own opinion, should not be factored in when calculating net worth.

Labels: Net Worth

1 Comments:

At 5:27 PM, Cal said…

Cal said…

Cool website. It's good that you keep track of your net worth. You don't want to be falling into the red and not be aware of it. I bought my first house last year and it was a big purchase, as I am 21. I didn't even have to fix anything, I made it my investment property and rented it out to cover the mortgage, with a positive cash flow. Check out my investment blog, where I post stock market news and trading results. If you don't have a high flying speculative stock in your 401k, maybe we could find you one. Thanks!

Post a Comment

<< Home