My Money Blog Goal

Labels: Goals

Young and inspired striving for financial freedom and all the perks that come with it, all while still having fun before I die and leave all of my hard earned money to my unborn children.

Labels: Goals

Is that all??? I need a second job.

Labels: Home and mortgage

Labels: Home and mortgage

Labels: Charities

Labels: Home and mortgage

Labels: Goals

Labels: Stock Market

Labels: Saving and Investing

Labels: Saving and Investing

When I calculated my net worth when I started this blog I purposely left out about $9,000 in savings because we were planning on using that money specifically for purchases on things for the house. We had (and still have) a lot of things we needed to buy:

When I calculated my net worth when I started this blog I purposely left out about $9,000 in savings because we were planning on using that money specifically for purchases on things for the house. We had (and still have) a lot of things we needed to buy:Labels: Home and mortgage

Labels: Home and mortgage

It's been a long day, but I think I can find some energy to identify some goals for myself. Long and short term personal, professional and financial goals are included. Keep in mind that these are all off the top of my head, so more could be added soon:

Personal Goals

#1: Lay new flooring in my new house to completion, without succumbing to pay someone to do it for me, and still make it look like it was professionally installed.

#2: Move into my new house by no later than November 25, 2006.

Professional Goals

#1: Obtain my Oracle Database 10g DBA OCP (Oracle Certified Professional) by March 3, 2007.

Financial Goals

Short term

#1: Pay off auto loans.

#2: Pay off credit cards 100%, cut those suckers up and never carry any more consumer debt.

Mid term

#1: Accumulate $15,000 in savings in our ING Direct money market account to use for emergency purposes.

#2: Start a "dream" money market fund to use for future vacations, both large and small.

Labels: Goals

Labels: Home and mortgage

Labels: Saving and Investing

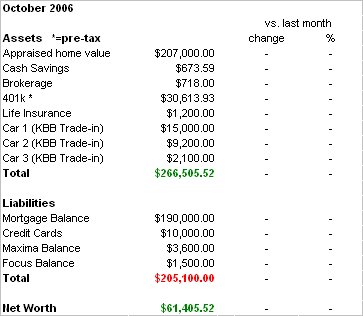

Net worth update:

This is a pretty good estimate of my net worth as of the end of October 2006. While the credit card debt may seem high, over half of it is on 0% interest credit cards. I couldn't resist buying a new DLP HDTV to go with our new house, but I'll have it paid off well before any interest would be applied to the card.

Labels: Net Worth